There were 5,627 home sales reported through the Toronto Regional Real Estate Board’s (TRREB) MLS® System in August 2022, representing a year-over-year dip of 34.2 per cent – a lesser annual rate of decline compared to the previous four months. The August sales result also represented a month-over-month increase compared to July.

Sales represented a higher share of new listings compared to the previous three months. If this trend

continues, it could indicate some support for selling prices in the months ahead. On a year-over-year

basis, the MLS® Home Price Index (HPI) was up by 8.9 per cent and the average selling price for all

home types combined was up by 0.9 per cent to $1,079,500. The average selling price was also up slightly month-over-month, while the HPI Composite was lower compared to July. Monthly growth in the average price versus a dip in the HPI Composite suggests a greater share of more expensive home types sold in August.

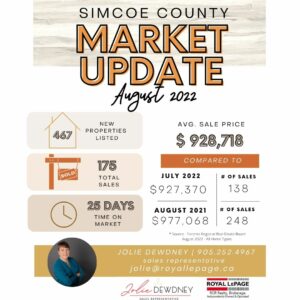

The average sales price in the City of Toronto has shown a slight increase since July and has shown a 3.2% increase compared to August 2021. In Simcoe County, the average sales price has also increased slightly since last month but showed a decrease of 4.9% compared to August of last year. York Region’s average sales price was down since July and decreased 1.9% compared to August 2021. More detailed information on each of these areas can be found in the charts below.

“While higher borrowing costs have impacted home purchase decisions, existing homeowners nearing mortgage renewal are also facing higher costs. There is room for the federal government to provide for greater housing affordability for existing homeowners by removing the stress test when existing mortgages are switched to a new lender, allowing for greater competition in the mortgage market. Further, allowing for longer amortization periods on mortgage renewals would assist current homeowners in an inflationary environment where everyday costs have risen dramatically,” said TRREB President Kevin Crigger.

“The Office of the Superintendent of Financial Institutions (OSFI) should weigh in on whether the

current stress test remains applicable. Is it reasonable to test home buyers at two percentage points

above the current elevated rates, or should a more flexible test be applied that follows the interest rate cycle? In addition, OSFI should consider removing the stress test for existing mortgage holders who want to shop for the best possible rate at renewal rather than forcing them to stay with their existing lender to avoid the stress test. This is especially the case when no additional funds are being requested,” said TRREB CEO John DiMichele.

“There are other issues beyond borrowing costs impacting housing affordability in the Greater Golden Horseshoe. The ability to bring on more supply is the longer-term challenge. However, we are moving in the right direction on this front. The strong mayor proposal from the province coupled with the recent commitment from Toronto Mayor John Tory to expand ownership and rental housing options are examples of this. TRREB looks forward to hearing additional initiatives from candidates vying for office in the upcoming municipal elections,” said TRREB Chief Market Analyst Jason Mercer.

If you have questions about the real estate market, or are thinking about buying or selling and are not sure where to start, please reach out! I would love to help!

*Source – Toronto Regional Real Estate Board, August 2022